The current cycling boom in France mirrors the one from the 1930s. Back then, with 9 million bicycles for a population of 40 million, the streets were bustling with cyclists. Artisans used cargo bikes, and workers commuted by bicycle, creating daily congestion that reflected a widespread enthusiasm for this quick and practical mode of transport.

Workers Leaving a Factory in France in the 1930s

Today, with 17 million bicycles for 68 million people, France is experiencing a similar cycling fever. Cargo bike deliveries are on the rise, and the bike lane on Boulevard Sébastopol in Paris sees no less than 15,000 cyclists each day.

This resurgence hasn’t been without its challenges. After World War II, motorization became the symbol of modernity. Motorbikes overshadowed bicycles, and the rise of affordable cars further diminished the use of bikes. However, bicycles have shown resilience, reemerging during crises. After the Kobe earthquake in 1995, bikes were essential. When public transportation becomes potential hubs of contamination and streets empty of cars due to the 2020 health crisis, cycling becomes both a barrier measure and an efficient means of transportation. As a result, the use of French bike lanes significantly increased (+30% each year between 2019 and 2021).

Even after the health crisis ended, cycling remained popular, attracting enthusiasts motivated by environmental concerns, time savings, health benefits, or financial savings.

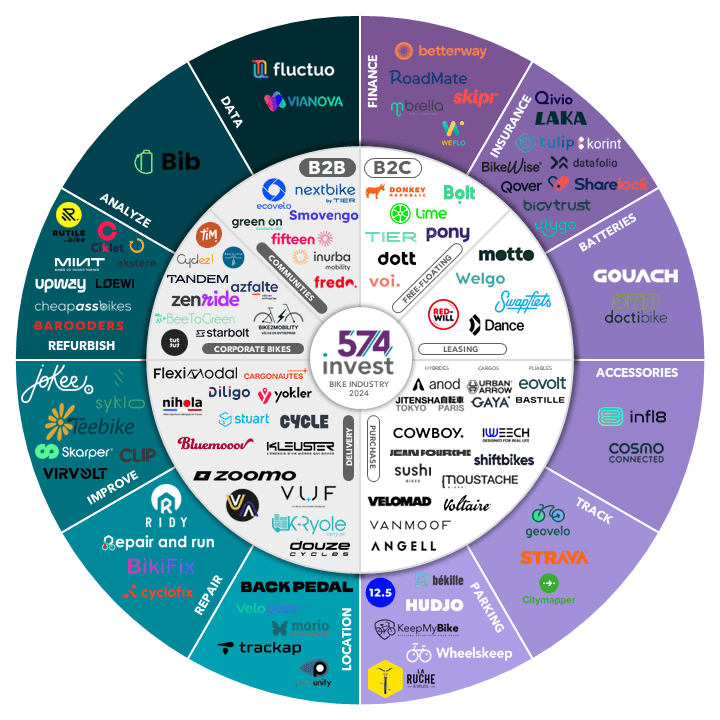

As an investor committed to decarbonizing mobility, 574 Invest invites you to dive into the heart of the cycling economy’s startup ecosystem.

The Success of Electric Bikes

The current cycling boom is closely tied to the rise of electric bikes. Despite a 16% decline in traditional bike sales in 2023, the e-bike market showed resilience with only a 9% drop. These declines are attributed to post-COVID overproduction and economic pressures rather than structural changes. In Île-de-France, bikes now account for 11.2% of urban trips, surpassing car trips (4.3%) for the first time.

State incentives like the bike bonus and conversion premium have boosted bike adoption. Local initiatives have also been important, offering practical solutions such as Véligo Location, an affordable e-bike subscription service by Île-de-France Mobilité. With only 6% of users discontinuing bike use after their subscription, this competitive offer effectively promotes cycling.

Moreover, station-based bikes networks, including electric and mechanical bikes, have popularized urban cycling, with a 13% increase in usage between 2022 and 2023. Micromobility providers like Lime, Tier, and Pony have also contributed to the democratization of electric bikes, seeing a 20% rise in users between 2022 and 2023. Interestingly, bikes generally receive more favorable reception from municipalities than electric scooters. Consequently, micromobility players increased the proportion of bikes in their fleets by 50% between 2022 and 2023 to better respond to tenders and adapt to this trend.

Bikes for Everyone

In recent years, the tech ecosystem has seen the rise of new e-bike players, bringing innovations for various customer targets. Van Moof, Cowboy, and the French brand Voltaire have added a genuine tech dimension to traditional e-bikes with features like remote unlocking and geolocation through mobile apps, appealing particularly to urban and young clientele. But e-bikes are not just about high-tech: cargo and family models are also gaining popularity. Practical for daily errands or trips with children, “long-tail” bikes are becoming a real alternative to cars. Startups like Gaya and Urban Arrow have invested in this booming segment.

The success of e-bikes has also led some startups to focus on electrifying regular bikes. Clip offers an accessory that attaches to a bike’s wheel to electrify the ride, while Teebike has created an electric motorized wheel to replace the front wheel of a regular bike.

Innovative Business Models

This product innovation goes hand in hand with the creation of new business models. Acquiring an e-bike, typically sold at an average price of €2,000, is a significant investment. Some prefer alternatives like long-term rental subscriptions offered by companies such as Dance or the French Motto. These new options allow users to enjoy the benefits of a personal electric bike, including maintenance and insurance services, without the initial purchase cost.

Similarly, company-provided bike, partially funded by the employer, is an attractive solution to reduce the financial burden of acquiring an e-bike. Startups like Zenride, Tandem, and Starbolt help businesses offer this new service to their employees. For employers, it’s a double win: reduced carbon footprint and improved quality of life at work, along with attractive tax benefits. For employees, it’s an opportunity to have a bike for both work and leisure, with significant financial savings. Those who used to drive to work save on insurance and fuel, while those considering buying a bike find this a more affordable alternative.

But other alternatives also exist. Introduced four years ago, the Sustainable Mobility Package, “Forfait Mobilité Durable” in french, provides employees with a financial allowance for their home-to-work travel, provided it is eco-friendly. Start-ups like Betterway and Skipr enable employees to pay for their monthly bike subscriptions or to use shared bikes for certain journeys, thus promoting a flexible approach to green mobility.

Startups like Zoomo and VélyVélo also offer leasing but for specific customer types: professional couriers. The use of bikes for urban delivery is highly successful, reducing carbon emissions and often saving time. Companies like Stuart develop decarbonized “last-mile” delivery solutions.

Innovative services to simplify cycling

When asked what would encourage them to bike more, many French people mention the availability of secure parking. Theft is indeed a major challenge associated with cycling.

In terms of parking, securing bikes is essential to prevent theft. Startups like 12.5 convert underground parking spaces into dedicated bike areas, while companies like La Ruche à Vélos install automated, secure bike garages. Complementary solutions are also emerging. For example, Velopass offers bike registration to reduce the black market and deter thieves. In case of bike theft, new insurance companies specializing in bike insurance, such as Sharelock or Laka, provide financial compensation.

Additionally, e-bikes require more maintenance, leading to the emergence of many specialized repair startups. Cyclofix, for instance, offers home repair services within 48 hours. Another model, BikiFix, provides a SaaS solution for scheduling appointments at professional repair shops—a sort of “Doctolib” for bikes—offering a digitalized experience for cyclists concerned about their bike maintenance.

Finally, startups like Upway and Loewi have entered the market for refurbishing and reselling e-bikes, allowing consumers to purchase refurbished electric bikes at much lower prices. Other startups, like Barooders, focus exclusively on resale, leaving reconditioning to specialized actors.

Sources :

- “Les ventes de vélo ont nettement reculé en 2023”, Le Monde, 2024.

- Enquête régionale sur la mobilité des Franciliens, L’institut Paris Région, 2024.

- Rapport sur le renouvellement de la DSP Véligo Location, Île de France Mobilités, 2023.

- European Shared Mobility – Annual Review 2023, Fluctuo, 2024.

- Guide d’achat « Bien choisir son vélo électrique », Que Choisir.

- CGDD/SDES, Enquête sur les pratiques environnementales des ménages, 2016.