“Why Hardware is Eating the World?”

This could be Andreessen Horowitz’s new blog title after the fund invested in Radiant’s Series B in April 2023, a startup designing portable nuclear reactors, contrasting with the famous 2009-article: “Why Software is Eating the World?”.

The trend, that started in 2022, is confirmed in 2023: startups designing hardware solutions are attracting investors. In 2022, 9 out of the top 10 Climate Tech fundraising in the world were conducted by hardware startups.

A hardware startup offers a physical solution, which forms the core of its offering, and usually combines it with software. In contrast, a software startup offers only a software solution and creates intangible products.

Hardware startups can mostly be classified as industrial startups or infrastructure startups, and they are currently gaining momentum. The manifestation of this trend began to be depicted in February when Les Echos published “Industrial startups are making headway in the Next40/FT120”, while in March, Sifted’s headline was “The rise of the infrastructure startup”.

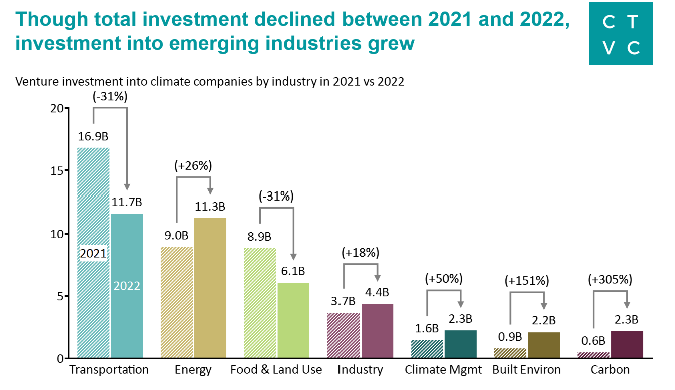

Though venture capital investments decreased between 2021 and 2022, several sectors characteristic of industrial startups (energy, industry, climate, carbon management) experienced a notable upswing.

Among noteworthy European industrial startups that raised significant amounts in 2022 were Verkor, Innovafeed, Northvolt, Climeworks, and Electra (in which 574 Invest is an investor).

In France, out of the €13.5 billion raised in 2022, €3.8 billion was invested in industrial startups, representing a growth of 36% year on year.

In Q1 2023, despite a 58% decrease in fundraising in Europe compared to Q1 2022, the Deeptech and Climate Tech sectors took the lead in terms of value, with €14.3 billion raised. Therefore, industrial startups operating within these two extensive categories continued to allure investors (approximately 80% of industrial startups identified by Bpifrance fall under the classification of Deeptech or Climate Tech).

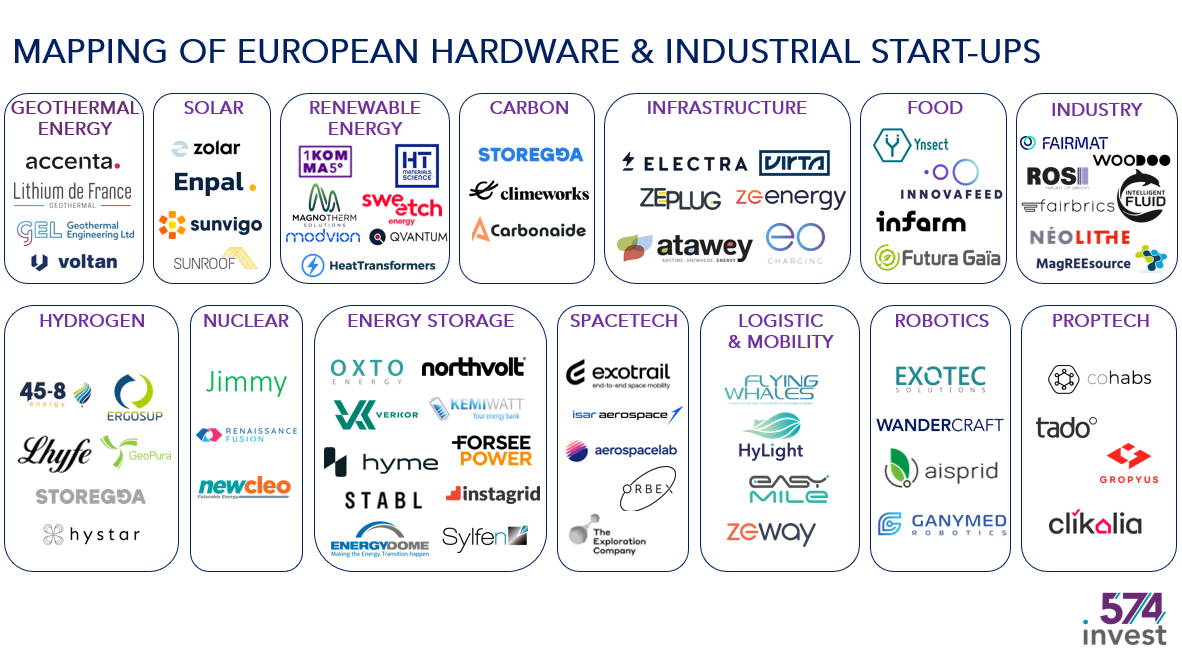

Here are a few instances to exemplify this trend. Enpal, a German B2C startup offering photovoltaic panels and batteries on a lease basis, raised €215 million (Series D) in January 2023. Ynsect, a French startup specializing in insect-based ingredient production, raised €160 million (Series D) in April 2023, and Lithium de France, a French player specializing in geothermal and lithium extraction, raised €44 million (Series B) in March 2023.

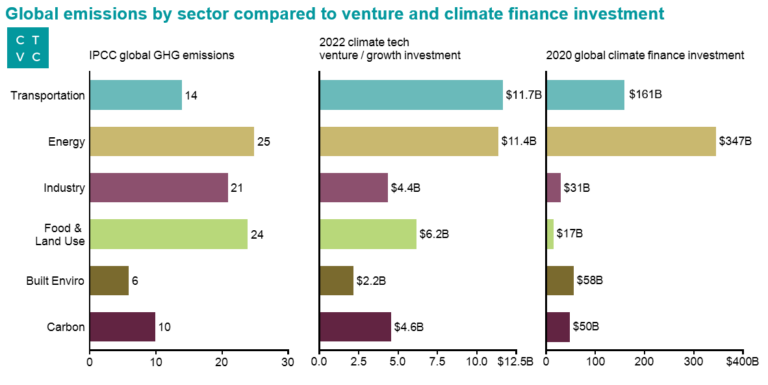

This new class of startups combines technical expertise and industrial capacity to combat the challenges posed by the climate crisis.

Their observation is simple: issues related to energy, land use, mobility, industry, and construction, which are components of the climate crisis, require hardware solutions. It is difficult to solve these problems using software alone because they are inherently physical. Software, while useful, cannot do it all.

Main feature of industrial startups: investors diversity

While traditional VC investors may feel justified in funding industrial startups during their early years (seed funding), they tend to be hesitant when it comes to funding the later stages – when founders start building large-scale hardware installations and structures. Some legitimate concerns include:

- High initial investment/market risk/difficulty to pivot: If the market doesn’t develop as expected or if competition is too strong, the startup may struggle to get back its CAPEX investments.

- Longer return on investment time: The time required to recover the invested CAPEX, and therefore the investment itself, is often longer than the lifespan of VC funds’ portfolios (c.10 years).

- The need for operational expertise from investors, which VC investors may not necessarily possess.

- Low share of recurring revenue in business models, which are frequently favored by VC investors.

New investors, more used to finance these types of investments and companies, are joining post-Series A funding rounds: infrastructure funds, corporate venture capital funds, corporates, banks, or pension funds.

The diversity of investors in Electra, Fairmat, and Enpal illustrates this point. This diversity brings specific values to industrial startups, including technical expertise, operational expertise, CAPEX financing, or historical industrial knowledge.

Mapping

574 Invest presents below a mapping of the European hardware startup ecosystem, most of them can be classified as industrial startups or startups with industrial aspirations (when younger).

It is undeniable that industrial startups have an important role to play in the fight against climate change.

Hence, we take great pride in supporting Electra and eagerly anticipate the promising growth of this market.

Sources :

- Sifted, The rise of the infrastructure startup, 03/2023

- Sifted, Biden’s climate bill lures carbon removal giant Climeworks to US, 04/2024

- Les Echos, L’accès au foncier, l’autre épine dans le pied des jeunes pousses industrielles, 04/2023

- Les Echos, Les start-up industrielles font une percée dans le Next40/FT120, 02/2023

- CTVC, $40B and 1,000+ deals in 2022 market downtick, 01/2023

- CTVC, Exiting Cleantech to Climate Tech, 02/2023